|

Home

| pfodApps/pfodDevices

| WebStringTemplates

| Java/J2EE

| Unix

| Torches

| Superannuation

| CRPS Treatment

|

| About

Us

|

|

Protecting Your Superannuation

|

by Matthew Ford 8th June 2025 (original

17st September

2009)

© Forward Computing and Control Pty. Ltd. NSW

Australia

All rights reserved.

Legal Disclaimer: I do not hold a Financial Advisor’s Licence and nothing in this article should be considered as recommending any particular course of action to anyone else.

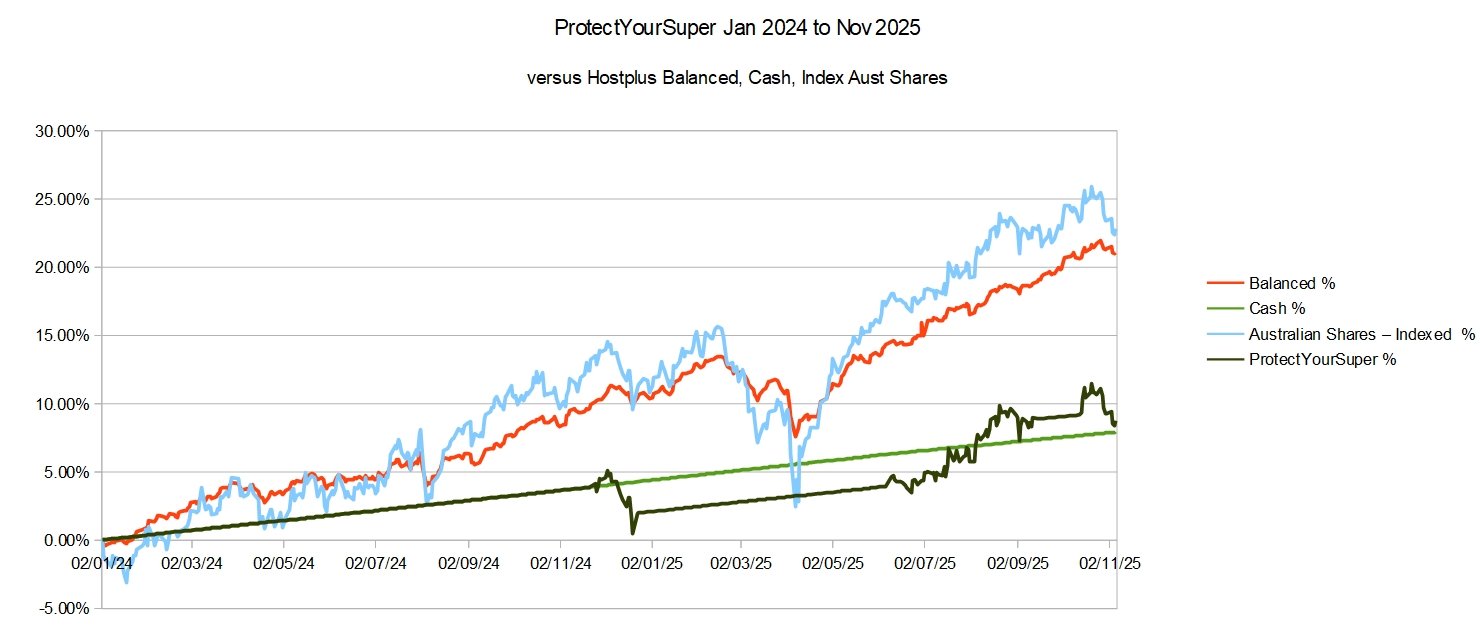

ProtectYourSuper is currently indicating a switch to Cash. The performance over the last two (2) years has not been noticeable better than cash. See the chart below

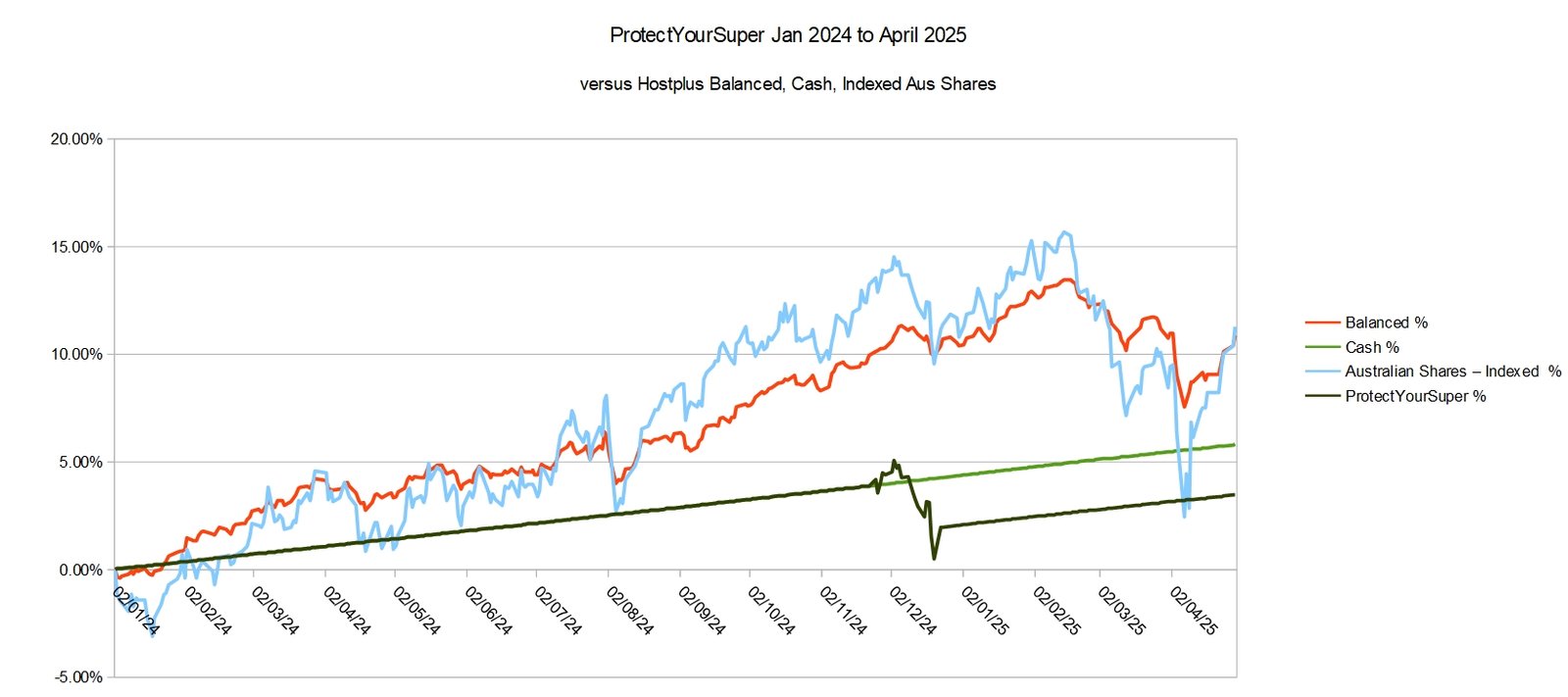

ProtectYourSuper has indicated a switch to Shares, however given the recent volatility of Shares, I currently have 100% of my Super in Hostplus Balanced. In the current environment ProtectYourSuper is very conservative. The Australian Shares fund has been very volatile, but Balanced (which mixes Shares, Cash and Fixed Interest) has been less so, as the chart in the previous commentary (30th April 2025) shows.

I currently have 100% of my Super in Hostplus Cash. Since the last switch to Shares was not profitable, see the chart below, ProtectYourSuper would normally stay in cash until a 'paper' trade switch to shares is profitable. That is don't use the switching system until it starts working again. However in order to catch the rebound after a severe fall, if the All Ords falls by more than 10% then switch to Shares when 11 day moving average > 33 day moving average AND the 33 day moving average > 99 day moving average. ProtectYourSuper Rev 2.3.1 includes this modified rule. So ProtectYourSuper is now waiting for as sustained rise 11>33 and 33>99 to switch back to shares.

The chart below shows ProtectYourSuper (black) versus Hostplus Balanced, Cash and Australian Shares (Indexed). In the current environment ProtectYourSuper is very conservative. The Australian Shares fund has been very volatile, but Balanced (which mixes Shares, Cash and Fixed Interest) has been less volatile.

I currently have 100% of my Super in Cash in Hostplus. The last switch to Shares was not profitable returning 2.8% less then a nominal 5% cash fixed interest. This means ProtectYourSuper will stay in cash until a 'paper' trade switch to shares is profitable. ProtectYourSuper is waiting for a profitable paper trade switch, based on the moving averages, before indicating a real switch to Shares. In other words don't use ProtectYourSuper to switch to Shares if it did not return more than 5% last time. That is if the system is not working don't use it.

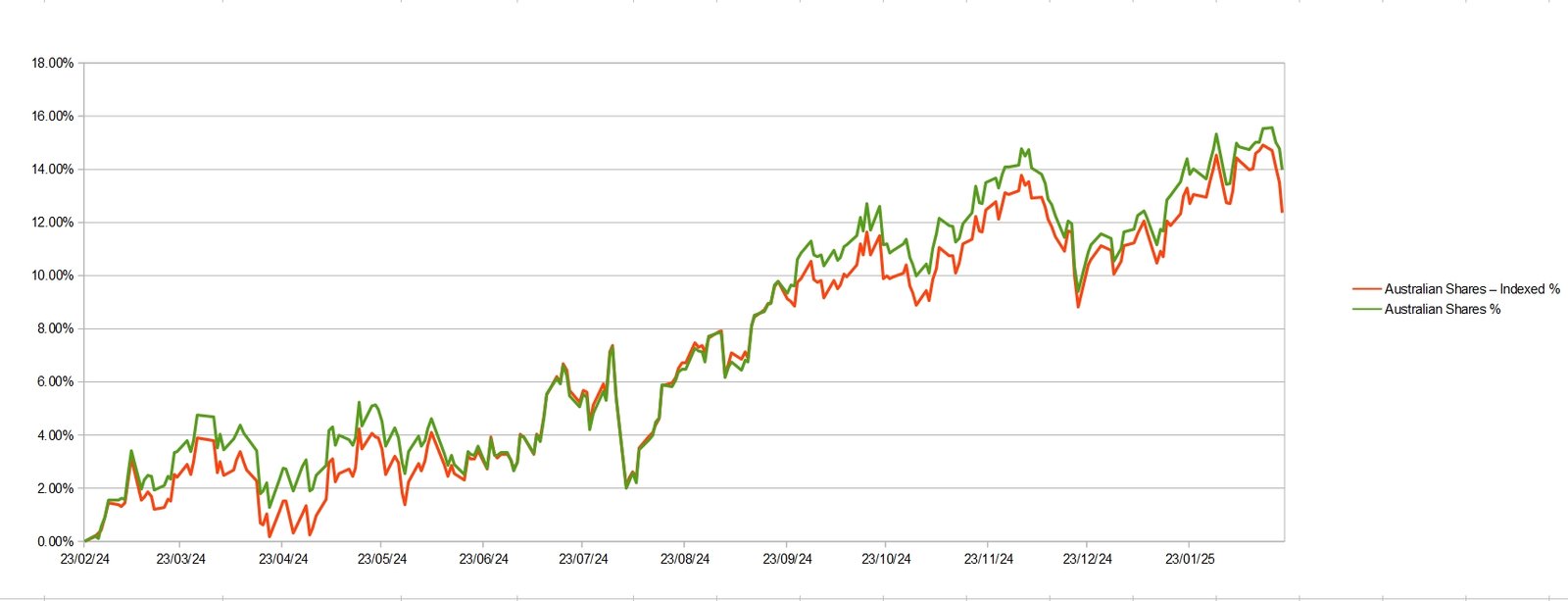

The chart below compares Hostplus Australian Shares with Hostplus Australian Shares Indexed. The expenses for Australian Shares is 0.47% versus 0.04% for Australian Shares Indexed. From the chart below it is debatable if the results are worth the extra expense. At the sharp drop on 5th Aug 2024, Australian Shares fell to 1.97%, while the Indexed fell to 2.01%. On the 20th Dec 2024, Australian Shares fell to 9.39%, while the Indexed fell to 8.8%. For the last date of the chart 20th Feb 2025, Australian Shares is 13.97% versus Indexed 12.36%. So sometimes Australian Shares does better then Indexed and some times it does about the same (but costs 0.4% more).

In future, I intend to switch from Cash to Australian Shares Indexed mainly because ProtectYourSuper switches based on the All Ord index, which Australian Shares Indexed most closely matches.

I currently have 100% of my Super in Cash in Hostplus. The chart below compares Hostplus Cash with Balanced and Australian Shares. Both Balanced and Australian Shares have risen recently. However ProtectYourSuper is still showing “Stay in Cash” because the last time the moving averages showed a switch to Shares the final gain, from in to out, was less then 5% (the nominal Cash rate). ProtectYourSuper is waiting for a profitable paper trade switch, based on the moving averages, before indicating a real switch to Shares. In other words don't use ProtectYourSuper to switch to Shares if it did not return more than 5% last time. This protects against ongoing losses in a sideways market, but means the first profitable switch in a rising market is missed.

I currently have 100% of my Super in

Cash in Hostplus. As the chart below shows, the recent falls in the

ASX have brought the Hostplus Australian Share's return back to the

same level as the much safer Cash.

Currently ProtectYourSuper is

still in Cash because the last time the 11 > 33 and 33 > 99

days moving average, a switch to Shares and back to Cash resulted in

less than 5% profit, the nominal safe Cash return. So the risk in

Shares was not worth it. ProtectYourSuper will not indicate a switch

to Shares until the previous 'test' switch returns a profit > 5%.

The last actual switch to Shares and back to Cash ended on 22 Dec 2022. That switch returned 2.5% less profit than just staying in Cash (assuming 5% interest). Since then ProtectYourSuper has been running tests, switching in to and out of Shares and checking the profit is greater than 5% (assumed Cash rate). So far none of those test have been successful due to the choppy nature of the share market. As shown below.

The box outline section shown below is a recent test which also failed to return a profit greater then 5%. You can see the start was late in the rise. This is because ProtectYourSuper will not switch to Shares until the 33 day moving average is above the 99 day moving average. (i.e. the Yellow line above the Blue line) As well as this ProtectYourSuper only checks once a week and that combined with Christmas further delayed the switch to Shares. So the first half of the rise was missed. ProtectYourSuper switched back to Cash when the 11 day moving average (Light Blue line) crossed below the 33 day Yellow line.

I now have 30% of my Super from Cash into HostPlus Australian Shares to be switched back to Cash if either RiskYourSuper indicates a switch (I.e a fall of >10% from the last high) OR if either of Rules 1 or 2 of ProtectYourSuper become False. The 10% previously switched to Hostplus International Hedged Indexed has been switched back to cash with an 8% gain.

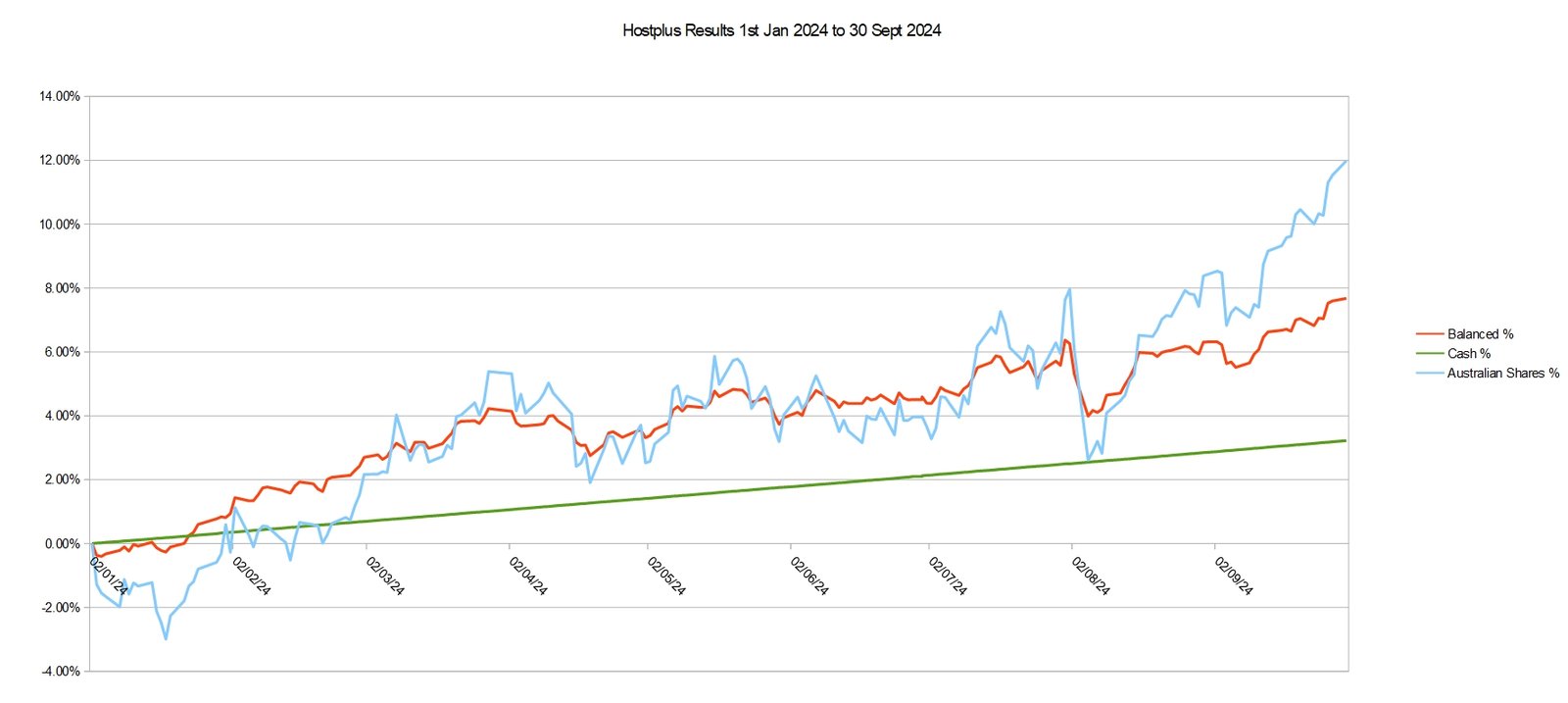

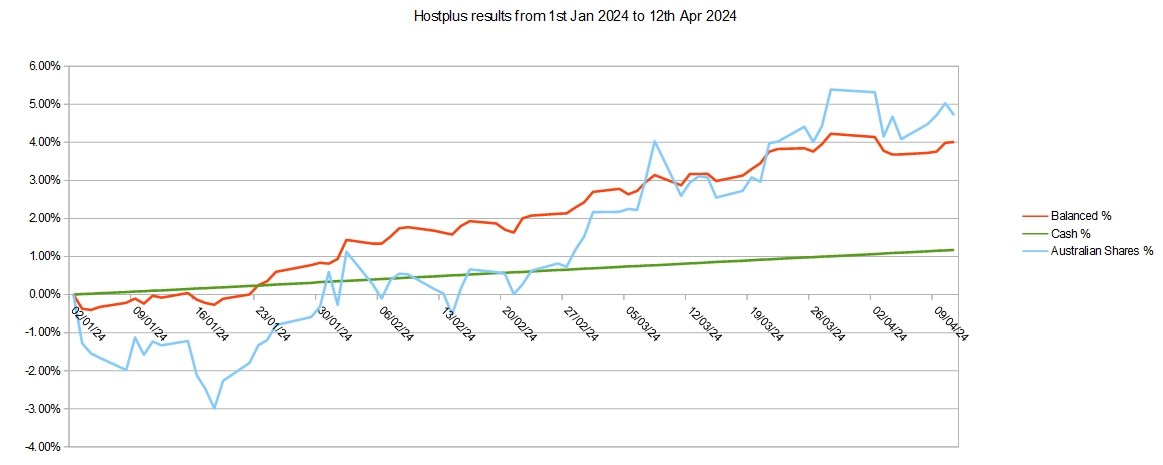

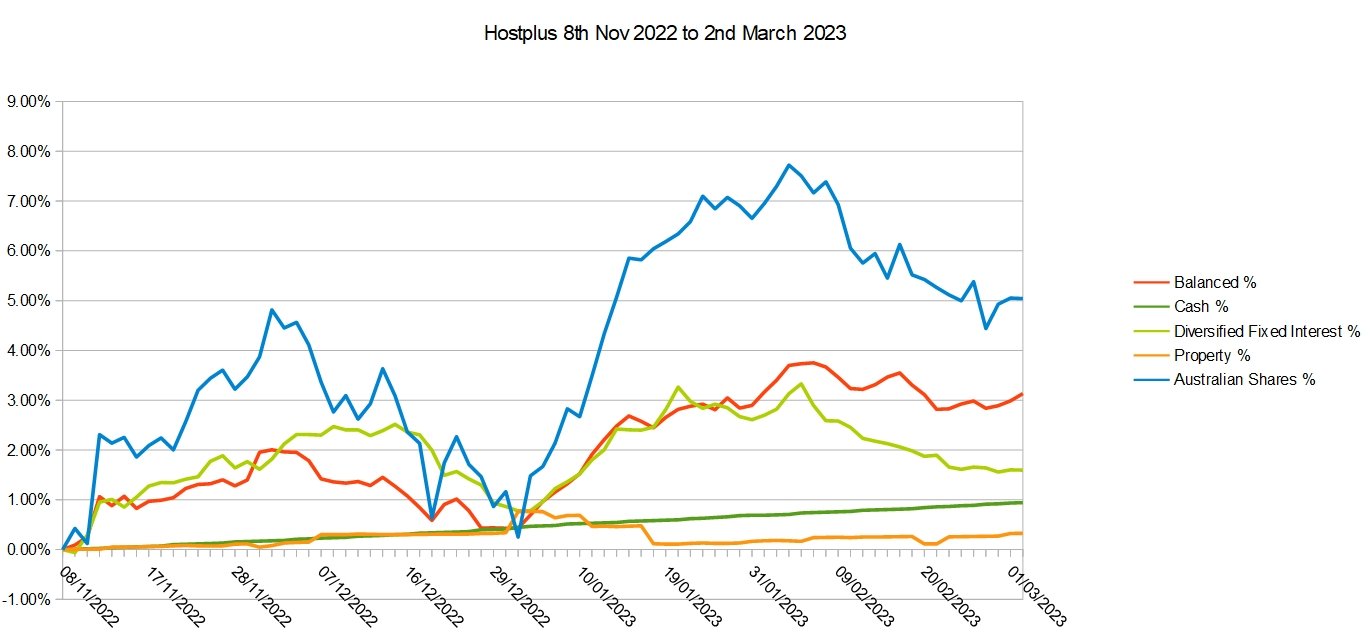

Here are the results for Hostplus since the beginning of the year

Cash

is on track to return about 4% a year. Balanced and Australian Shares

have done better in the last few months, but as mentioned previously

we are no longer in the very low interest rate environment that

RiskYourSuper was designed for and the last application of

ProtectYourSuper returned a profit of less then 5% and so was not

worth the risk. So I am not moving 100% of my super into shares just

now as neither RiskYourSuper nor ProtectYourSuper are recommending

that.

However the new highs the All Ords are making has convinced me to switch 30% of my super into Australian Shares.

I only have 30% in shares because a) the safe cash interest rate is still relatively high (RBA 4.35%) so we are not in a fully RiskYourSuper environment and b) for the previous 2 years the share market has been going sideways. Rule 3 of ProtectYourSuper is designed to keep you out of Shares in sideways markets. It remains to be seen if ProtectYourSuper will return a profit (above 5%) this time.

For this 30% in Australian Shares I am using two exit conditions:-

1) a fall of 10% from the last high i.e. a possible loss of ~3%

of my total super.

OR

2) if Rules 1 or 2 of ProtectYourSuper

become False.

I have moved 20% of my Super from Cash into HostPlus Australian Shares to be switched back to Cash if either RiskYourSuper indicates a switch (I.e a fall of >10% from the last high) OR if either of Rules 1 or 2 of ProtectYourSuper become False.

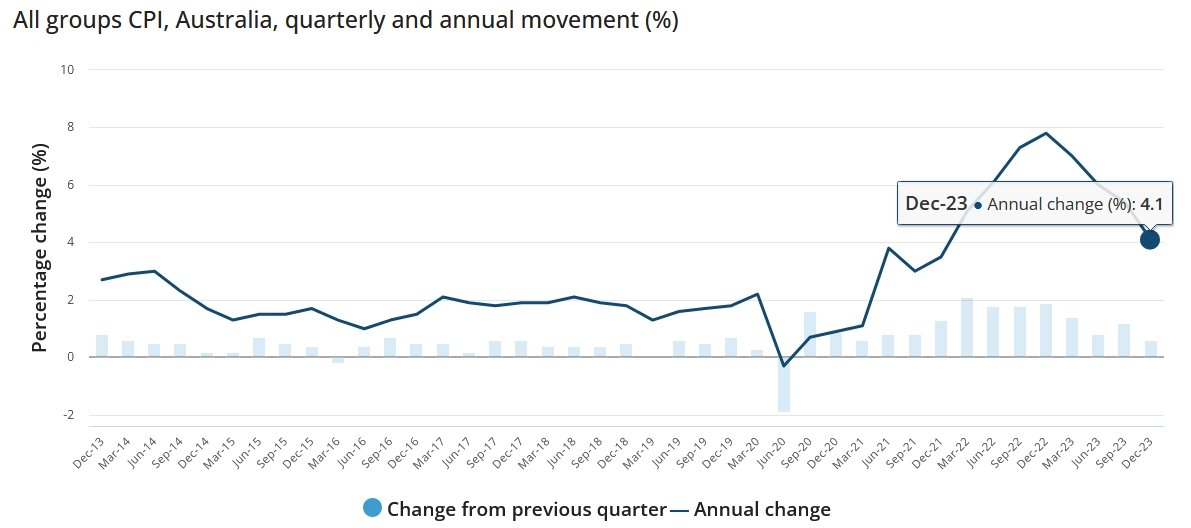

Two things have changed in the last month.

1) The Australian

Inflation Rate has fallen noticeable,

https://www.abs.gov.au/media-centre/media-releases/cpi-rose-06-cent-december-2023-quarter

2) the Australian All Ords has made new all time highs. (see weekly 5 year chart below from bigcharts.marketwatch.com)

The rapid fall in the CPI indicates the RBA may cut interest rates this year in which case we would be transitioning from a ProtectYourSuper environment (high interest rates) to a RiskYourSuper environment (low interest rates).

Looking at the chart above you can see that the 99day SMA line has turned up on a weekly basis at the end of December last, indicating a RiskYourSuper switch to Shares (if not already in Shares). Checking ProtectYourSuper results shows the short term and long term moving averages (Rules 1 and 2) are positive to switch to shares, the 33/99 SMA having crossed up late December. However ProtectYourSuper did not trigger a switch to Shares because the last attempted switch using the moving averages (Rules 1 and 2) only returned 2.1% (i.e. 2.9% below the nominal 5% minimum 'risk' free cash rate).

So in summary, both RiskYourSuper and ProtectYourSuper (ignoring the failure in Rule 3) indicate switching to shares. This combined with the falling CPI putting further rate rises on hold and the share market making new all time highs has convinced me to switch 20% of my super into Australian Shares.

I am only switching 20% because a) the safe cash interest rate is still relatively high (RBA 4.35%) so we are not in a fully RiskYourSuper environment and b) for the previous 2 years the share market has been going sideways. Rule 3 of ProtectYourSuper is designed to keep you out of Shares in sideways markets. It remains to be seen if the market will break out of this sideways pattern.

For this 20% in Australian Shares I am using two exit conditions:-

1) a fall of 10% from the last high i.e. a possible loss of ~2%

of my total super.

OR

2) if Rules 1 or 2 of ProtectYourSuper

become False.

For full disclosure I also have 10% of my super in HostPlus

International Shares (Hedged and Indexed) as a proxy for the US share

market, the remaining 70% is in Cash. The hedging should remove the

exchange rate variation risk. Because the US is the largest

international market, indexed means it will have the most impact of

this fund.

Note: This switch is purely speculative and is not

using either RiskYourSuper or ProtectYourSuper rules and its

profit/loss will not be reported on.

ProtectYourSuper Rev 2.3.1 (ProtectYourSuper2_3_1.jar ) has been updated to read the share data from au.investing.com/indices/all-ordinaries-historical-data

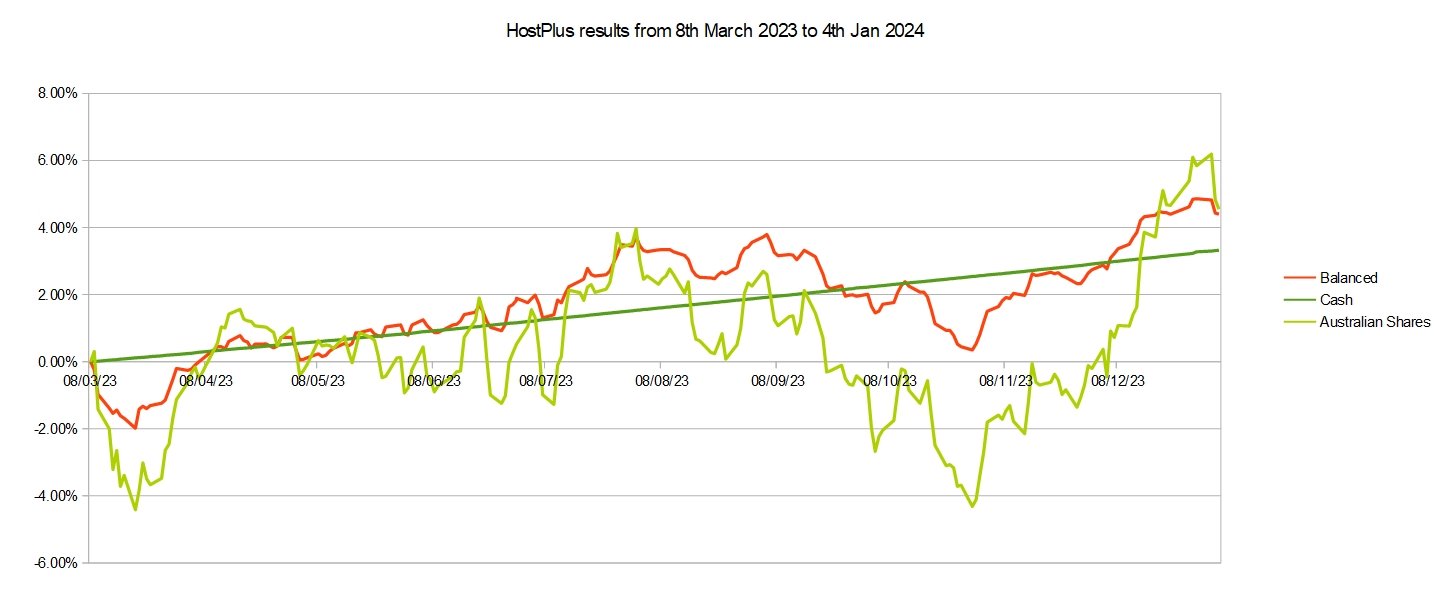

I currently have 100% of my super in Hostplus cash returning ~4% pa. Below is a chart of the % change in some Hostplus funds from the 8th March 2023 to 4th Jan 2024

The return from Hostplus Balanced and Australian Shares since 8th

March 2023 is about 1.2% higher than Cash, but with a much higher

variation.

ProtectYourSuper is currently showing Stay in Cash

since the previous attempt to switch to Shares using the moving

averages returned less than 5% (only 2.1%).

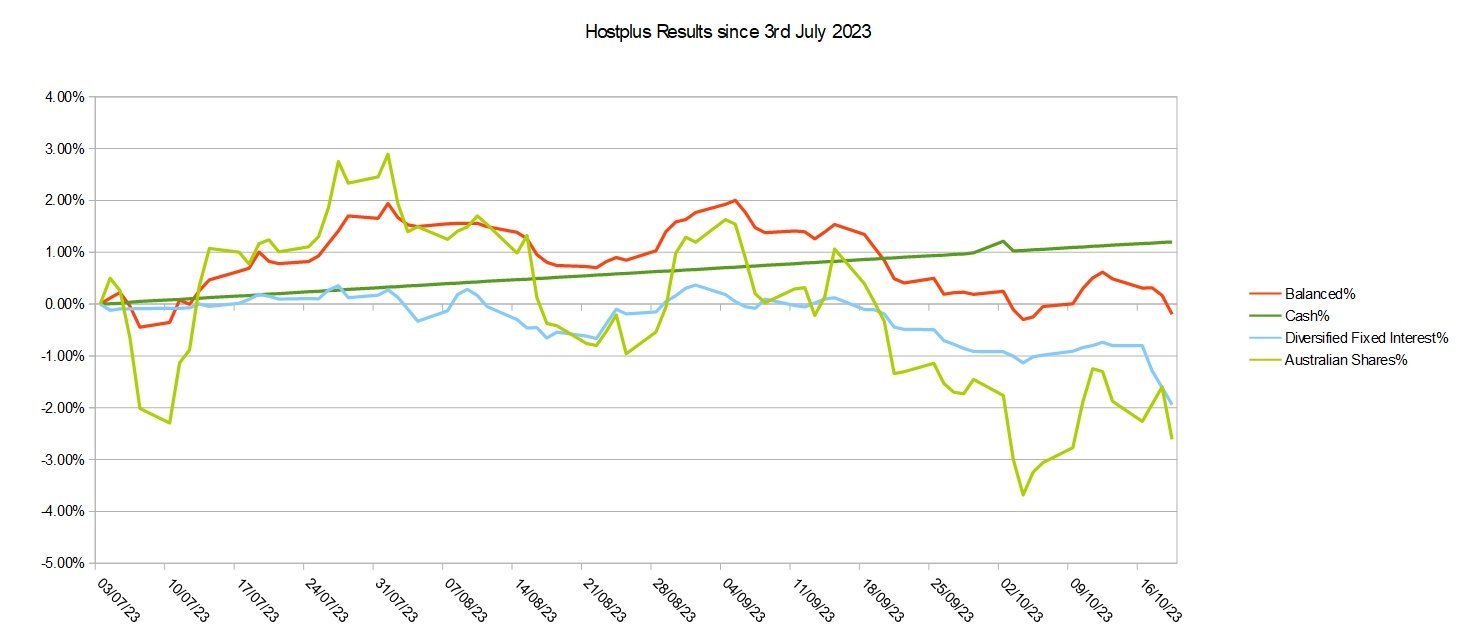

I currently have 100% of my super in Hostplus cash returning ~4% pa. Below is a chart of the % change in some Hostplus funds from the 3rd July to 20th October 2023

This

shows that Hostplus Cash has out performed Hostplus Australian

Shares, Balanced and Diversified Fixed Interest (Property is not

longer a Hostplus investment option). Cash is also much more stable

than any of the others. This validates my previous decision to switch

to 100% cash.

Looking forward, it appears we may be transitioning from RiskYourSuper back to ProtectYourSuper. ProtectYourSuper was biased towards Cash except when the Shares were rising strongly. Currently the Australian Share market appears to be going sideways while Hostplus Cash is returning 4% a year with zero risk which makes Cash look like the way to protect your super until such times as the Australian Share market starts rising strongly again. Given the current downward trajectory of the US market and the tendency for the Australian Share market to follow in a knee jerk reaction to any sudden falls in the US market, it appears prudent to stay in 100% Cash for the time being. Once the Australian Share market starts rising strongly again, the level of the Cash interest rate will determine whether I use RiskYourSuper (low interest rates) or ProtectYourSuper (higher interest rates) to guide the allocation of my superannuation.

“Hostplus will close

the Property and Infrastructure investment options, with effect

from 1 October 2023. Members will be unable to switch into these

options from 1 September 2023. “

So Property will no longer

be available as a 'Cash' alternative.

Below is a chart of the % change in some HostPlust funds versus the All Ordinaries since the 8th March 2023 when I switched 50% of my super from Cash to Hostplus Australian Shares

This shows that Hostplus Australian Shares have out performed the All Ordinaries by about 3% so far, but that Hostplus Cash is still slightly better and much more stable.

Looking forward, it appears we may be transitioning from RiskYourSuper back to ProtectYourSuper. ProtectYourSuper was biased towards Cash except when the Shares were rising strongly. Currently the Australian Share market appears to be going sideways while Hostplus Cash is returning 4% a year with zero risk which makes Cash look like the way to protect your super until such times as the Australian Share market starts rising strongly again. Given the current downward trajectory of the US market and the tendency for the Australian Share market to follow in a knee jerk reaction to any sudden falls in the US market, it appears prudent to switch back to 100% Cash. So I have switched my super to 100% cash and will leave it there until the Australian Share market is rising strongly again.

I have switched 50% of my super to HostPlus Australian Shares and 50% to HostPlust Cash.

On the 5th Nov 2022, RiskYourSuper

indicated switching to shares. At that point I switched 10% into

shares and left 90% in Property. The chart above shows the results

since then. Points to note:-

a) Cash, the safest place for my

super, has a better return than Property over the last 4 months and

is on track to return more than 4% over 12 months.

b) Diversified

Fixed Interest is variable, but may be a choice once the interest

rates stop rising.

c) Australian Shares are more volatile (i.e.

risky) then Balanced.

I am offsetting the extra risk of Shares in two ways:- 1) The All Ordinaries Share index is already ~4% down from their high and so reducing the loss to around 6%, if RiskYourSuper signals an exit. 2) Only putting 50% in Shares halves that risk again to around 3%, if there is a severe fall in the Australia Share market of more than 10% from its high at the beginning of Feb 2023.

The economic environment is transitioning from the very low interest rates the prompted the development of RiskYourSuper, back towards the high interest rates that were the basis of ProtectYourSuper. For the time being I am continuing to use the RiskYourSuper switching rules and leaving some of my super in the 'Cash' alternative as a means of mitigating the risk and letting me sleep at night.

A new version of the RiskYourSuper program,

V1.1.2, is available that handles the current date format from

https://au.investing.com/indices/all-ordinaries-historical-data

That site seems to change the date format often so expect further

revisions.

The RiskYourSuper program has just indicated a switch to shares, so I have moved 10% of my super from HostPlus Property to HostPlus Australian Shares. I have only moved 10% so as to satisfy my capacity for risk. I want to be able to sleep at night. HostPlus Property has returned 4.3% over the last 6months (i.e 8.6%pa) and is steadily rising. On the other hand HostPlus Australian Shares is much more volatile, down -2.3% over the last 6 months and dropping over -10% in between, so I am being cautious. I chose HostPlus Australian Shares in preference to my previous choice of HostPlus Balanced, because while HostPlus Balance is less volatile, Balanced includes some Fixed Interest which is current falling (-1.9% over the last 6 months) and is likely to continue to fall until the Reserve Bank of Australia stops raising the interest rate.

A new version of the RiskYourSuper program,

V1.1.2, is available that handles the current date format from

https://au.investing.com/indices/all-ordinaries-historical-data

That site seems to change the date format often so expect further

revisions.

Currently I my superannuation is 100% Hostplus Property waiting for the 99 day moving average to start going up.

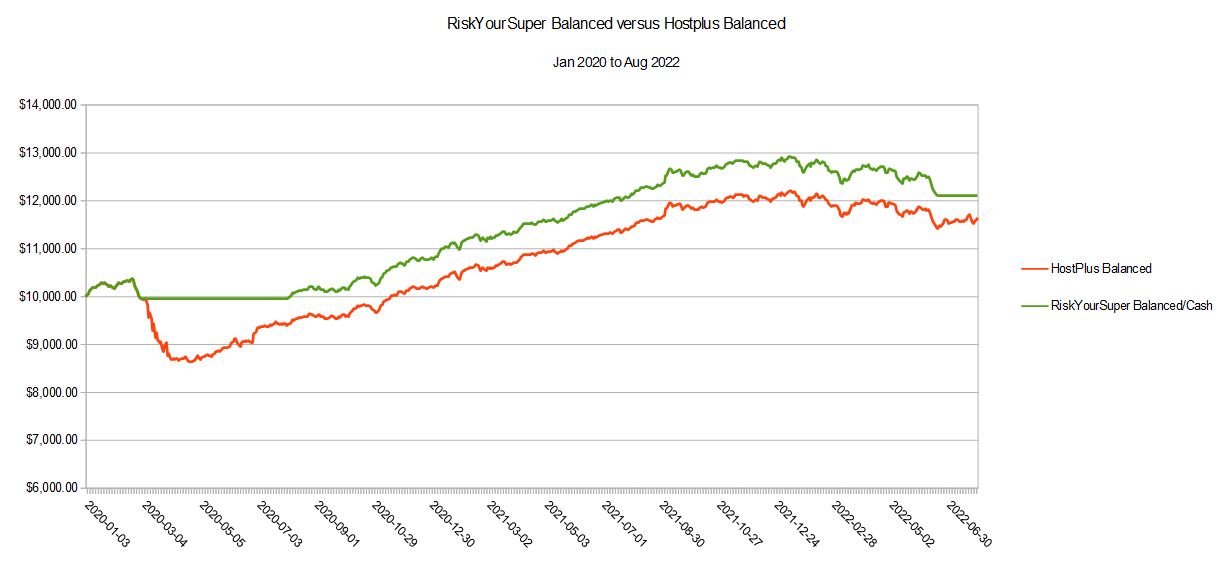

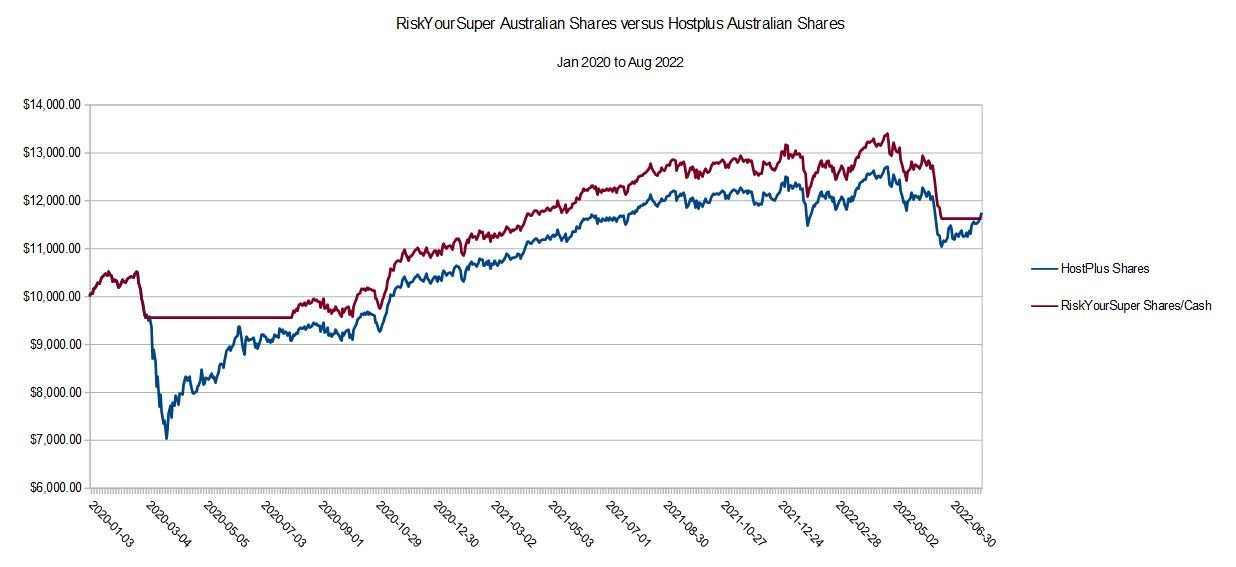

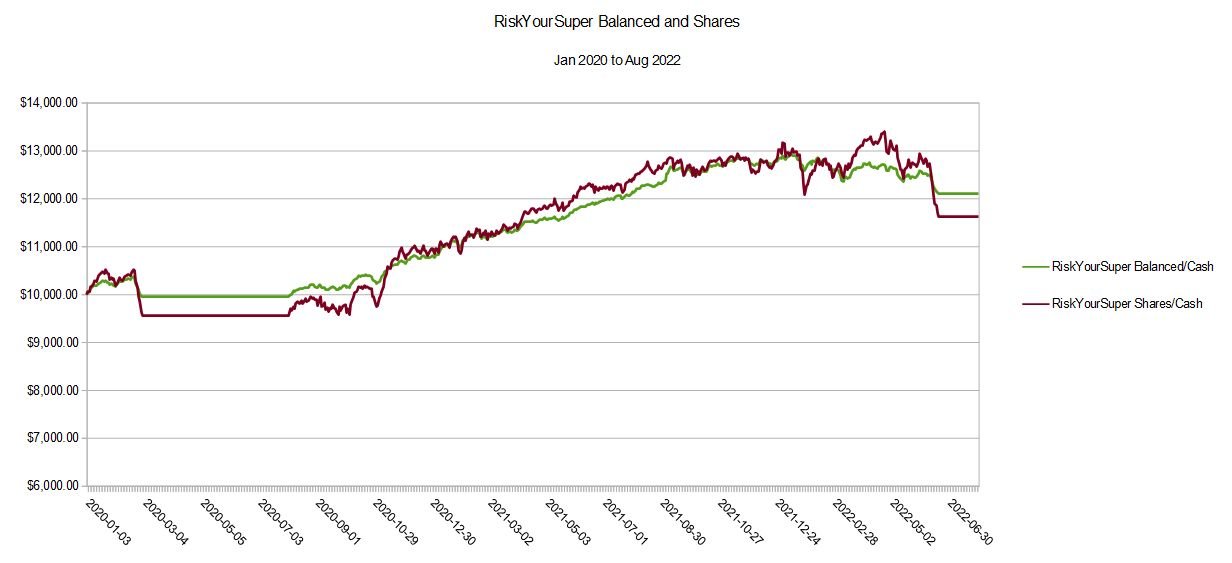

This is a review of the performance of RiskYourSuper since Jan 2020. First a recap. ProtectYourSuper was introduced in the aftermath of the Global Financial Crisis on the basis that if you could get a good interest rate for Cash, you should only risk your superannuation in Shares when they were going up. ProtectYourSuper used short term and long term moving averages of ASX All Ords to indicate switches into and out of super share funds, quickly switching out of shares if the short term moving average was falling and staying out until the long term moving averages were rising again. A summary of the performance of ProtectYourSuper is shown here. ProtectYourSuper worked well up to 2019, but as the interest rates fell (see Australian RBA interest rate chart below), its conservative approach fell behind superannuation shares and balanced funds returns. See the table of 1,3,5 year returns.

So RiskYourSuper was introduced. As

discussed here, back testing of the following rules worked well

since 2009:-

Invest

in a Super Fund with exposure to Shares (i.e. Australian Shares Fund

or a Balanced Fund) and stay in that fund until the share market

drops by 10% from the highest level when in invested in shares. After

switching out of shares, stay out of shares until the 99 day moving

averages starts to turn up (on a weekly basis).

Here are the results since Jan 2020 for RiskYourSuper switching between Hostplus Balanced and Hostplus Cash (~0% interest). The flat part of the Green RiskYourSuper line is when it is in Cash.

Here are the results since Jan 2020 for RiskYourSuper switching between Hostplus Australian Shares and Hostplus Cash (~0% interest). The flat part of the Blue RiskYourSuper line is when it is in Cash.

When RiskYourSuper was introduced switching between Balanced and Cash was preferred to switch between Shares and Cash as it reduced the risk of capital loss when a share market dropped by 10% forced a switch to cash. As shown above while both choices protected against large drops, Balanced/Cash had less volatility and gave a better result than Shares/Cash. It is more easily see below in the combined plot. The Green line is the RiskYourSuper Balanced result while the Red line is the RiskYourSuper Shares result.

The plots above assume switching between 100% Cash and 100% Balanced or Shares. As noted when RiskYourSuper was introduced I was wary of how the COVID pandemic was going to play out in the share market so I initially only switched 50% of my superannuation into Balanced and left the rest in cash (see the Commentary 8th July 2020) and then progressively moved to 100% Balanced (see the Commentary 29th April 2021). In hindsight switching 100% Balanced would have been better, but a more cautious approach let me sleep a night.

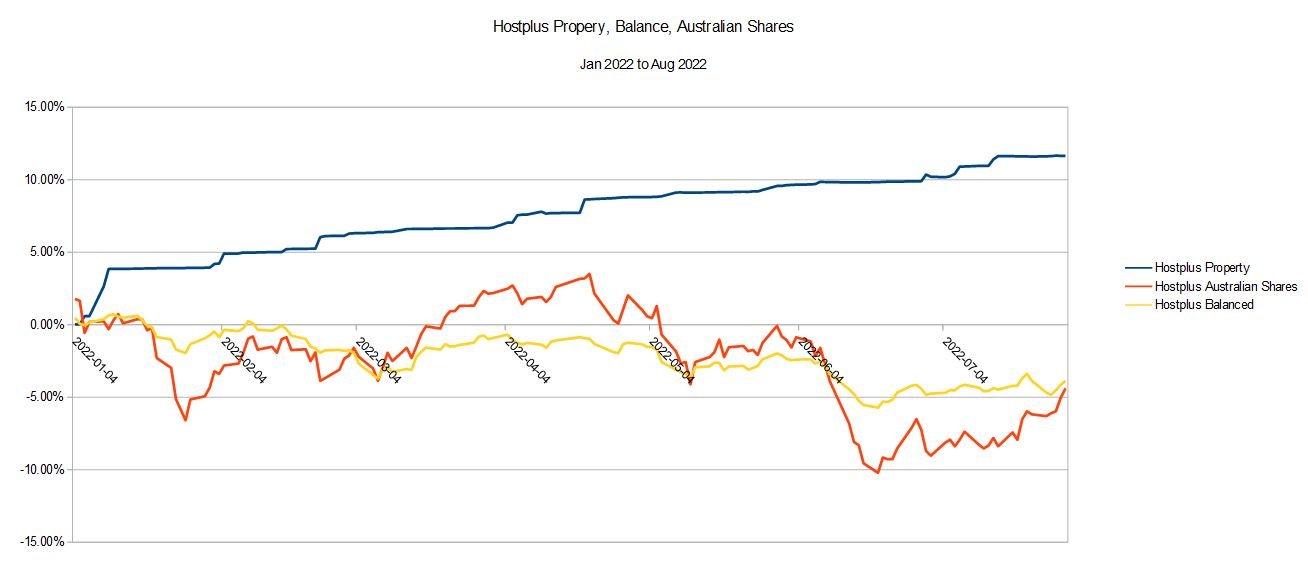

In Jan 2022 (see the Commentary 22nd January 2022), I moved to 50% Balanced and 50% Hostplus Property and then in March (see the Commentary 9th May 2022) I moved to 100% Hostplus Property due to the weakness in the share market as discussed in those commentaries. Here is a plot of Hostplus Property, since Jan 2022, versus Australian Shares and Balanced.

This plot shows that over the last 7 months Hostplus Property was some 15% better than Hostplust Australian Shares or Hostplus Balanced and more importantly has not declined. However when the Australian All Ords drops by 10% from its last high, I still switch to 100% Cash until the dust settles, as Property can drop suddenly some weeks after the share market falls and Hostplus reserves the right to freeze redemptions.

Currently my superannuation is 100% Hostplus Property waiting for the 99 day moving average to start going up indicating a switch back to Hostplus Balanced.

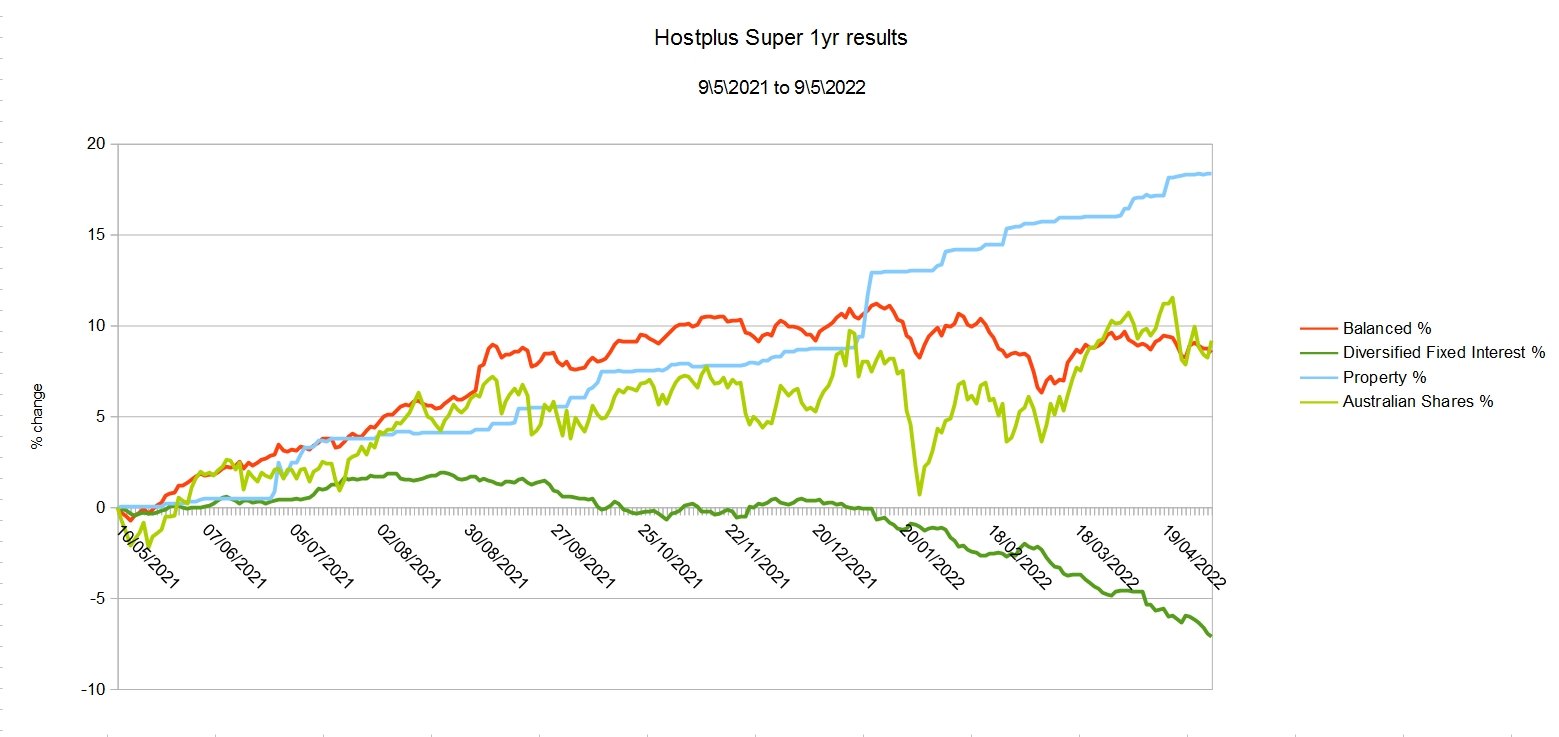

Here is a chart of the % change in a selection of Hostplus superannuation funds from 9th May 2021 to 9th May 2022

This chart shows Diversified Fixed Interest falling from about August 2021 and Balanced and Australian Shares going sideways. In the last three (3) months the fall in Diversified Fixed Interest has increased as the interest rate (proposed/actual) increases make current bond holdings of the fund less valuable compared to the new bonds on offer. Depending on the terms of the bonds the fund holds, it will take some time for the this fall to reverse. This fall in be value of 'old' bonds is reflected in the decline of the Balanced fund also which includes as percentage of Fixed Interest investments.

Compared to the Balanced and Fixed Interest Funds, the Australian Share fund looks better. However there is a lot of talk of a recession in the US which is unsettling the US and Australian markets at the moment.

The standout plot is the return from Property. As noted in a previous commentary I had a 50% Balanced / 50% Property split, because a) I was not comfortable with 100% shares/balanced and b) the Cash returns are essentially zero. Note: Australian Super no longer offers a pure Property fund and Hostplus has put investors on notice that redemptions from its Property Fund can be paused in extreme situations. If the share market crashes, a pure CASH fund is the safest place to be.

As the Balanced and Share Fund started to decline, I revised my 'risk' profile to 100% Property. This change was not forced by a RiskYourSuper exit to Cash as the Australian All Ords has not yet fallen 10% from it recent high. OK this breaks Rule 1: but my being comfortable with the risk is more important than any rule. Of course the question for me now is when to get back into Shares. Given the recent falls in the US and Australian share markets and the steady rise in the Property fund I am in no hurry.

RiskYourSuper

V1.1 now uses the share data manually downloaded from

au.investing.com. As the name suggests the RiskYourSuper approach has

more risk.

It has been boring for the last 9 months, but in the

last week the US market has been falling. However the Australian All

Ords is currently only -5.5% below the most recent high.

RiskYourSuper stays in 'shares' until they drop by more than 10%

which has not happened yet. I am currently using HostPlus Balanced as

my 'share' alternative and currently my super is split 50% Balanced

and 50% Property to satisfy my 'risk' profile. If the All Ords has a

Friday close more then 10% below the last high (i.e. below 7,134), I

will switch all my super to 100% Cash Fund.

RiskYourSuper

V1.1 now uses the share data manually downloaded from

au.investing.com. As the name suggests the RiskYourSuper approach has

more risk.

No change in the last 3 months. RiskYourSuper stays in

'shares' until they drop by more than 10% which has not happened. I

am currently using HostPlus Balanced as my 'share' alternative and

currently my super is split 100% Balanced and 0% Cash.

RiskYourSuper

has superseded ProtectYourSuper

as the method I am using for my superannuation in a low interest rate

environment. As the name suggests the RiskYourSuper approach has more

risk.

No change in the last 3 months. RiskYourSuper stays in

'shares' until they drop by more than 10% which has not happened. I

am currently using HostPlus Balanced as my 'share' alternative and

currently my super is split 80% Balanced and 20% Cash.

RiskYourSuper has superseded ProtectYourSuper as the method I am using for my superannuation in a low interest rate environment. As the name suggests the RiskYourSuper approach has more risk.

As detailed on the RiskYourSuper page (and previous commentaries), RiskYourSuper stays in 'shares' until they drop by more than 10%. I am personally not comfortable with that level of risk to my capital so instead of investing in 100% Shares, I am putting my super in HostPlus Balanced. Balanced funds tend to drop less than a pure share fund. To further reduce the risk, I have not put 100% of my super in the Balanced fund. Currently I am 70% Balanced / 30% Cash invested with the intent to increase that to 100% Balanced as I feel more comfortable. However for the purposes of comparison in the charts below and in the published results, I will assume 100% investment in HostPlus Balanced when switched to 'shares' and 100% HostPlus Cash when switched to 'cash'.

Fix for “Java Exception”

One user has

reported a “Java Exception” when trying to run the

RiskYourSuper.jar file. He has yet to provide the log files so I can

track this down, but running the .jar file via a shortcut worked for

him.

i) right click on the RiskYourSuper.jar and create a short

cut

ii) right click on the shortcut and open properties and

change the target text to

C:\Windows\System32\cmd.exe /k java

-jar RiskYourSuper1_0_0.jar -V

Apply and close

Now you should

be able to click on the short cut to run the jar file.

You can

also now pin the shortcut to you start menu or task bar (right click

on the shortcut to open the menu to show these options)

RiskYourSuper has superseded ProtectYourSuper as the method I am using for my superannuation in a low interest rate environment. As the name suggests the RiskYourSuper approach has more risk.

ProtectYourSuper was biased toward 'cash' and only moved into shares when there was a noticeable trend upwards. However the success of ProtectYourSuper depended on there being an acceptable return when not in Shares (e.g. nominally 5%pa in cash/property). Because the alternatives to shares are currently returning almost zero, RiskYourSuper is biased towards staying in Shares and will only exit when the AllOrds drops by 10%. This means there is a higher risk to the value of my Super account when using RiskYourSuper.

There are various way I could limit the effect a 10% drop in the AllOrds would have on the value of my super account. The exact mix depends on when I think I will need to access my super, do I have enough cash/income to fund my expenses in the foreseeable future, etc, and will I have the stomach to make the switch to cash after the share market has fallen by 10%.

One way to adjust the risk would be to only put say 50% in Shares and leave the rest in Cash, so that a 10% drop would be ~5% reduction in the value of my Super account. Because of the higher risk, in my particular circumstance, I am not committing all my super to 100% shares. What I have actually chosen to do is to put 50% into Hostplus Balanced Fund which has some shares exposure and leave 50% in Hostplus Cash fund. So when the All Ords falls by 10% only half of my super is effected and of that I expect a fall of only 5% or so in the Balanced Fund. So the overall fall in the value of my super will be about 2.5% when the All Ords falls by 10% and RiskYourSuper says to switch to cash.

I find that my appetite for risk is not as large as I

thought it was so I have switched to 50% Balanced and 50% Cash. The

new Risk Your Super method aims to stay in 'shares' as long as

possible and only switches to 'cash' when the All Ords fall by

greater than 10% from the last high (since switching to shares). The

difficulty with this is being able to emotionally take the 'loss' and

switch to 'cash'. Looking at taking a 10% loss, it can be a very hard

to make the decision to take the loss and the temptation is to just

ignore the problem and not switch to 'cash'. That would leave me at

risk of even more losses.

SO I mitigate the difficulty in

'pulling the trigger' (switching to 'cash') by reducing the both the

% of my super invested in 'shares' AND investing in Balanced instead

to pure Shares. The Balance fund seems to drop only about half as

much as the All Ords fall. So by only risking 50% of my super AND by

investing in Balanced instead of Australian Share reduces my risk of

loss to about 2.5% for a 10% drop in the All Ords. That is 10% fall

in Shares is approximately 5% fall in the Balanced Fund and by only

risking 50% of my super the loss is limited to 2.5%. So when the

share market drops by 10% and the Risk Your Super method says I

should switch out of 'shares' then I will find it much easier to

accept the 2.5% loss and move to 'cash' to protect against further

falls.

The choice if how much super to risk in the share market and whether to invest in Australian Shares or Balanced is a very personal decision. My choice, as explained above, is to invest 50% in Hostplus Balanced Fund and leave 50% in the Hostplus Cash Fund.

I am in the process of moving from ProtectYourSuper to RiskYourSuper. As the name suggests the RiskYourSuper approach has more risk.

ProtectYourSuper was biased toward 'cash' and only moved into shares when there was a noticeable trend upwards. However the success of ProtectYourSuper depended on there being an acceptable return when not in Shares (e.g. nominally 5%pa in cash/property). Because the alternatives to shares are currently returning ~0%, RiskYourSuper is biased towards staying in Shares and will only exit when the AllOrds drops by 10%. This means there is a higher risk to the value of my Super account when using RiskYourSuper.

Because of the higher risk, I am not committing all my Super to 100% shares. There are various way I could limit the effect a 10% drop in the AllOrds would have on the value of my Super account. The exact mix depends on when I think I will need to access my super, do I have enough cash/income to fund my expenses in the foreseeable future, etc. One way to adjust the risk would be to only put say 50% in Shares and leave the rest in Cash, so that a 10% drop would be ~5% reduction in the value of my Super account. What I have actually chosen to do is to put 25% into Shares and 75% into Balanced, so a drop of 5% in the All Ords would result in ~25% of 10% and 75% of half of 10% (based on the latest results) = ~ 6.25% reduction in the value of my Super account.

The software program for RiskYourSuper is still under development, but I will be switching back to 100% cash if the All Ords falls by 10% or more.

I am in the process of

reworking ProtectYourSuper to take into account the ~0% interest rate

for cash and the -ve returns for property.

In the mean time I have

moved 25% of my super balance to Australian Shares leaving 75% in

Cash, with the proviso that if the All Ords drops back below 5600 I

will move back to 100% Cash

The charts have been

updated for the last quarter. ProtectYourSuper is currently in 100%

pure Cash Fund until the market turmoil subsides.

Hostplus has

just announced that it HAS THE POWER to freeze switching

between funds. This is not an immediate problem for ProtectYourSuper

as it will be some time before the 33day moving average crosses above

the 99day moving, allowing a switch back to shares. (The

previous commentary stated Hostplus has frozen switches, this does

not appear to be the case at present)

A new version of ProtectYourSuper V2.2.1 has been released. This V2.2.1 update modifies Rule3 to ignore the last switch's profit/loss in cases when the market has fallen more then 10%. Rule3 was designed to avoid using Rules 1 and 2 when they don't work, i.e. in a sideways market. Clearly when the market has fallen more than 10%, it is not a sideways market.

Back testing of ProtectYourSuper V2.2.1 shows it would have returned an extra 10% since 2008. However back testing has also shown that for ProtectYourSuper to be effective it needs to have a 'Cash' alternative that returns 5% or more per annum to switch into when not in shares. Prior to this latest downturn Hostplus's Property Fund was used as that alternative. During the previous GFC, Property Funds had significant negative returns. So for the time being ProtectYourSuper is in 100% pure Cash Fund. Pure Cash Funds return almost 0% and so are not a viable long term alternative. It remains to be seen what happens when the market starts to recover.

The use of a Property

Fund as the 'cash' alternative comes with the proviso that I will

switch to 100% Cash Fund if:-

a)

the Property Fund drops by 0.5% OR

b) the share market

drops by >10% OR

c) I have any worries about

risks to my super

The Hostplus Diversified Fixed Interest is not responding as expected so ProtectYourSuper has moved back to 100% Cash until things settle down

During the GFC, 10 years

ago, Diversified Fixed Interest rose while Shares and Property fell.

This was due to the interest rate reductions that made existing

bonds, with higher interest rates, worth more. This time around there

is not the same potential for a rise as the interest rates are

already very low, however given the very low cash rates,

ProtectYourSuper has moved to 100% Hostplus Diversified Fixed

Interest.

Note: Other super fund's Fixed Interest

funds will have different results.

In particular AustralianSuper

Diversified Fixed Interest dropped by 0.87% (-0.87%) between 4th

March 2020 to 10th March

2020

while over the same period Hostplus Diversified Fixed

Interest rose by 0.6% (+0.6%) between 4th

March 2020 to 10th March

2020

Fixed Interest funds results will vary depending on their mix

of local/overseas, hedged/unhedged investments.

Running the

ProtectYourSuper program on 29th Feb 2020, has indicated "Exit

Shares, Switch to Cash"

The current ProtectYourSuper would

normally switch to a 'cash' alternative, currently Property, however

since the share market has dropped ~10% in the last week, I switched

all my super to a pure CASH fund for safety until the market settles

out.

Also, I recently switched to the Firefox browser and noticed that when I downloaded the latest share data from Yahoo, Firefox did not warn me I already had an old ^AORD.csv file. Instead it just automatically downloaded the data to ^AORD(1).csv. This meant when I continued running the ProtectYourSuper program it told me I was missing data. Deleting the old ^AORD.csv file and renaming the ^AORD(1).csv file to ^AORD.csv and re-running ProtectYourSuper2_1_13.jar gave the latest result.

The charts have been

updated for the last quarter year. As mentioned below

ProtectYourSuper is now 100% in Hostplus Property Fund. However for

comparison purposes ProtectYourSuper's results will continue to be

compared against Australian Super's Balanced and Share

funds.

Currently ProtectYourSuper is in 100% Shares.

The charts have been

updated for the last quarter year. As mentioned below

ProtectYourSuper is now 100% in Hostplus Property Fund. However for

comparison purposes ProtectYourSuper's results will continue to be

compared against Australian Super's Balanced and Share

funds.

Currently ProtectYourSuper has just exited Shares. That

switch into and out of Shares made a small loss so Rule 3 is now

false. ProtectYourSuper will not switch into 100% shares until after

a 'paper' trade based on Rules 1 and 2 is profitable.

The charts have been

updated for the last financial year. As mentioned below

ProtectYourSuper is now 100% in Hostplus Property Fund. However for

comparison purposes ProtectYourSuper's results will continue to be

compared against Australian Super's Balanced and Share

funds.

Currently ProtectYourSuper has just exited a 'paper' trade,

i.e. a pretend trade, in Shares. That 'paper' trade was profitable so

next time both moving averages turn up (Rules 1 and 2),

ProtectYourSuper will switch to 100% shares.

The

ProtectYourSuper.jar file has been updated to Rev 2.1.13 to match

Yahoo's share data format changes.

The charts have been

updated for the previous quarter. As mentioned below ProtectYourSuper

is now 100% in Hostplus Property Fund. However for comparison

purposes ProtectYourSuper's results will continue to be compared

against Australian Super's Balanced and Share funds.

Currently

ProtectYourSuper is monitoring a 'paper' trade, i.e. a pretend trade,

in Shares to see if it makes a profit based on the moving averages.

The moving averages (Rules 1 and 2) that ProtectYourSuper uses to

switch into and out of shares are not always profitable so

ProtectYourSuper does not used them until they have proved to be

successful the last time (Rule 3).

As of 11th February, I have move all of my super from AustralianSuper to Hostplus. The chart below shows why.

The chart is back testing

ProtectYourSuper on Hostplus versus AustralianSuper from 9th

November 2017 to 17th January 2019. Hostplus only started

publishing daily unit prices from 9th November 2017.

The

red line AustralianSuper's

results and the blue line is

Hostplus' results for ProtectYourSuper. When the yellow

line is up,

ProtectYourSuper is in 100% Australian Shares. When the yellow line

is down, ProtectYourSuper is in Property. In Hostplus that is 100%

Property, but AustralianSuper limits Property investments to 70% of

your balance so the AustralianSuper result is for 70% Property / 30%

Cash fund.

The Hostplus result is noticeable better. This is due to i) a much better return for the Hostplus Property Fund (versus AustralianSuper's Property Fund) and ii) Hostplus not limiting investment in its Property Fund.

Even if Hostplus and AustralianSuper has similar returns for their Property Funds, Hostplus would still be preferred since it allows 100% to be invested in Property. See the Previous Commentaries for more info on the recent changes to AustralianSuper Property fund conditions.

The rest of this page still talks about AustralianSuper results as there are none yet for Hostplus. This will be updated next quarter.

There are only three (3) AustralianSuper finds that don't involve shares. Those are Property, Diversified Fixed Interest and the Cash fund. Previously ProtectYourSuper has used Property as the 'cash' alternative when not in 100% shares.

From

AustralianSuper

Property dropdown

“Important

information about the Property option

From Monday 19 November

2018 there is a cap on how much you can invest in the Property option

and AustralianSuper has the discretion to freeze switches,

contributions and withdrawals into and out of the Property option for

a maximum of up to two years. A freeze will only be applied when we

feel it is in the best interests of members and we will notify you as

soon as possible after it has been imposed.

For more information

please see Property option – additional information here.”

Read

that page carefully for the details.

That makes the Property Fund a bit more risky, since it may be frozen for up to 2 years. However it has been returning significantly higher returns over the last few year compared to the Diversified Fix Interest or the Cash Fund. So I have choosen to keep using Property as a 'cash' alternative. 70% is the maximum AustraliaSuper allows for Property, so when ProtectYourSuper in not in 100% Australian Shares it will be in 70% Property and 30% Cash.

However

given the risks with Property, ProtectYourSuper will switch to 100%

Cash if

a) the Property Fund drops by 0.5% OR

b) the share

market drops by >10% OR

c) I have any worries about risks to

my super

As at the 14th January 2019, the Share market has recovered above -10% from the last high AND the 11 day moving average is above the 33 day moving average, so ProtectYourSuper has moved from 100% Cash to 70% Property / 30%Cash

Commentary Update 24th November 2018

AustralianSuper has re-opened the Property Fund for investment (up to 70% only), however in the mean time the Australian Share market has dropped 10% and has not yet recovered. When stock market corrections like this are under way, I get nervous and would prefer to have all my super in the Cash Fund. So for the moment I am leaving all my super in the AustralianSuper Cash Fund. This means I can put off answering the above two questions for now.

Commentary Update 11th October 2018

This

update has nothing to do with the recent drops in the share market.

ProtectYourSuper switched to 100% Property some weeks ago. This

update is about the changes AustralianSuper has announced to it

Property Fund. From AustralianSuper

Property dropdown

“Important

information about the Property option

From Monday 19 November

2018 there is a cap on how much you can invest in the Property option

and AustralianSuper has the discretion to freeze switches,

contributions and withdrawals into and out of the Property option for

a maximum of up to two years. A freeze will only be applied when we

feel it is in the best interests of members and we will notify you as

soon as possible after it has been imposed.

For more information

please see Property option – additional information here.”

Read

that page carefully for the details.

Since I cannot for see how the Property Fund price might change due to this forced dis-investment, I have moved from 100% Property to 100% Cash until at least 19th Nov 2018 when AustralianSuper completes the changes.

In

the meantime, I will leave you with two questions to consider:-

a)

Since at least 30% of the Property, the Cash Alternative

for ProtectYourSuper, has to be

moved to another Fund, what Fund should that be?

b) Having

answered a), what %, if any, should be left in Property given it may

be frozen for up to 2 years.

Having been 100% Shares for the last few months, ProtectYourSuper recently switched back to its 'cash' alternative, i.e. AustralianSuper Property. This switch into and out of shares resulted in a small loss so Rule 3 is now false and ProtectYourSuper will stay out of Shares until there has been a profitable 'paper' switch into and out of Shares.

The charts and yearly returns have been updated to end of financial year 2018. ProtectYourSuper is currently 100% Shares.

The charts have been updated to 16th April 2018. Not much change since the last update 3 months ago. Rule 3 is true and ProtectYourSuper will switch to shares the next time share market turns up. That is when the 11 day moving average is higher then the 33 day moving average AND the 33 day moving average crosses above the 99 day moving average. Until that happens ProtectYourSuper is still in Property (its 'cash' alternative).

The charts have been updated to 10th Feb 2018. For the first time in over 12 months the last paper (pretend) switch into and out of shares was profitable. So rule 3 is now true and ProtectYourSuper will switch to shares the next time share market turns up. That is when the 11 day moving average is higher then the 33 day moving average AND the 33 day moving average crosses above the 99 day moving average. Until that happens ProtectYourSuper is still in Property (its 'cash' alternative).

The charts have been updated for the first quarter of 2017-18 financial year. Nothing much happening in the last 12 months. ProtectYourSuper is still in Property (its 'cash' alternative) waiting for a profitable switch into and out of shares so that Rule 3 becomes true. Results for last financial year (2016-17) are given below. ProtectYourSuper continues to provide similar returns, over the last 9 years, as the Australian Super Shares and Australian Super Balanced funds but ProtectYourSuper has a much lower variation in return from year to year and so far has never had a negative return (lost money).

Nothing much happened in the last 9 months. ProtectYourSuper is still in Property (its 'cash' alternative) waiting for a profitable switch into and out of shares so that Rule 3 becomes true. Results for last financial year are given below. ProtectYourSuper continues to provide similar returns, over the last 9 years, as the Australian Super Shares and Australian Super Balanced funds but ProtectYourSuper has a much lower variation in return from year to year and so far has never had a negative return (lost money).

Nothing much happened in the last 6 months. ProtectYourSuper is still in Property (its 'cash' alternative) waiting for a profitable switch into and out of shares so that Rule 3 becomes true.

As noted in the last commentary, the rule 3 was true and so when the market turned up, ProtectYourSuper switched into shares between 18th July and 2nd Sept 2016. Unfortunately that switch lost money, based on the All Ordinary share prices, so rule 3 is now false again and ProtectYourSuper will stay out of shares until there is a successful paper trade which makes rule 3 true again. Actually the last switch made money based on the AustralianSuper fund prices, but this was just lucky (or perhaps good management on the part of AustralianSuper).

This update has the end of financial year results. For almost all of the last financial year ProtectYourSuper has been in AustralianSuper Property, except between 26th August 2015 to 12th October 2105 when I switched to Cash, for complete safety, as the share market collapsed. Last financial year the return for ProtectYourSuper was twice that of either AustralianSuper Shares or Balanced funds.

The last 'paper' switch into shares using just rules 1 and 2 resulted in a profit (rule 3 is now true), so the next time the share market rises sufficiently to satisfy rules 1 and 2 (short term and long term moving averages going up), ProtectYourSuper will switch into 100% Shares.

As at 2th April 2016, ProtectYourSuper is still in the AustralianSuper Property 'cash' alternative. The last time ProtectYourSuper was in shares was 4th May 2015. The AustralianSuper chart below shows the relative performance of Property versus Balanced and Shares since 4th May 2015. As indicated on the chart, I switched from the Property to the Cash fund, from 26th August 2015 to 12th October 2105. In a share market crash, none of the 'cash' alternatives are as safe as pure CASH.

If the Share market continues to move higher then rules 1 and 2 will become true this weekend. However since the last switch to Shares did not make a profit, ProtectYourSuper will not be switching to shares this time but will just wait and see what happens. In the mean time the AustralianSuper Propery fund, which is my current 'cash' alternative, continues to be on track to provide about 8% return for the year, based on last years results and the first 6 months of this financial year.

Since ProtectYourSuper switched out of 100% Australian Shares on the 1st May 2015, the All Ordinaries has dropped 13% and has currently recovered to be 5.3% down from 1st May but still 7.5% down from its recent peak. On the 26th August I switched from the AustralianSuper Property 'cash' alternative to Australian Superannuation Cash fund as a precaution. However AustralianSuper Property appears to have weathered the market volatility, so on the 12th October 2015, I switch back to 100% AustralianSuper Property as my 'cash' alternative.

ProtectYourSuper is unlikely to switch to Shares in the foreseeable future. The stock market will have to mount a sustained recovery, then a pull back and then continue upward before ProtectYourSuper will risk going into shares again. In the mean time the AustralianSuper Propery fund appears on track to provide about 8% return for the year, based on last years results and this last quarters result. I continue to sleep soundly at night.

Since ProtectYourSuper switched out of 100% Australian Shares on the 1st May 2015, the All Ordinaries has dropped 13%. I have avoided this loss using one of the 'cash' alternatives, however given the dramatic falls in the last few days, I have moved to 100% AustralianSuper Cash fund. This fund gives very low but very stable returns. Once the share market shows signs of a steady recovery, I will consider switching back to one of the other 'cash' alternatives, like AustralianSuper Property, Fixed Interest, Diversified Fixed Interest, but in the mean time I will sleep soundly at night.

Australian Shares have recovered in the last three (3) years but their volatility has mostly kept ProtectYourSuper out of shares. This combined with the very low cash rates has impacted ProtectYourSuper's relative performance. Using a 'cash' alternative, like AustralianSuper Property, helps but not enough to keep up with a 100% shares fund. It is tempting to abandon the ProtectYourSuper method and just trust to a Balanced or 100% Share fund. However the gyrations of the Chinese market, the advance notice given by the US FED of a raise in US interest rates and the recent drops in the Australian Share market makes me nervous enough to continue with the more stable, if lower, returns offered by ProtectYourSuper. You may note that ProtectYourSuper quickly switched out of Australian Shares, on the 1st May 2015, as the Australian share market started to drop.

For the last quarter, the Australian share market has been very volatile. Moving averages, which ProtectYourSuper uses, do not perform well in this type of market. So not surprisingly ProtectYourSuper has been in “cash” most of the time since December 2013. ProtectYourSuper will continue to stay mainly in “cash” until the market state changes to one in which moving averages start being profitable again.

Currently ProtectYourSuper is about 19% below the AustralianSuper Australian Share fund since 2008, and about 15% below the AustralianSuper Balanced fund over this period. Also the very low Cash rate means that the ProtectYourSuper (Cash/Shares) is slow to recover from its drops. Other alternatives to “cash” such as AustralianSuper Property Fund and AustralianSuper Fixed Interest fund are doing much better, but are not as safe as pure cash, so I continue to plot the most conservative and safest option of AustralianSuper Cash fund. However you may like to consider one of these alternatives in the short term for a better return.

Have updated the charts and performance results for last financial year. Also added a share dividend component to the historical plots. As you can see from the chart below since Nov 2013 the Australian share market has been very volatile with sharp rises and falls. Moving averages, which ProtectYourSuper uses, do not perform well in this type of market. So not surprisingly ProtectYourSuper has been in “Cash” most of the time since December 2013. ProtectYourSuper will continue to stay mainly in “Cash” until the market state changes to one in which moving averages start being profitable again.

Currently ProtectYourSuper is about 10% below the AustralianSuper Australian Share fund since 2008, and about 6.3% below the AustralianSuper Balanced fund over this period. However the plot also shows that ProtectYourSuper has succeeded in avoiding the 20% and 30% drops the AustralianSuper Australian Share fund has experienced since July 2008 and so continues to for fill its aim of ProtectingYourSuper.

In the charts below the “Cash” fund is the Australian Super Cash fund. There are other alternatives that could be used such as the Property Fund or the Australian Fixed Interest fund. These often have a better return then the Australian Super Cash fund, but not always, and are a riskier alternative. As I mentioned in the last commentary, the results and charts here are for the most conservative and safest option of the Australian Super Cash fund.

As you can see from the chart below since Nov 2013 the Australian share market has been very volatile with sharp rises and falls. Moving averages, which ProtectYourSuper uses, do not perform well in this type of market. So not surprisingly ProtectYourSuper has been in “Cash” since December 2013. ProtectYourSuper will continue to stay in “Cash” until the market state changes to one in which moving averages start being profitable again.

Currently ProtectYourSuper is about 5% below he AustralianSuper Australian Share fund since 2008, and slightly ahead of the AustralianSuper Balanced fund over this period. However the plot also shows that ProtectYourSuper has succeeded in avoiding the 20% and 30% drops the AustralianSuper Australian Share fund has experienced since July 2008 and so continues to for fill its aim of ProtectingYourSuper.

In the charts below the “Cash” fund is the Australian Super Cash fund. There are other alternatives that could be used such as the Property Fund or the Australian Fixed Interest fund. These often have a better return then the Australian Super Cash fund, but not always, and are a riskier alternative. As I mentioned in the last commentary, the results and charts here are for the most conservative and safest option of the Australian Super Cash fund.

As mentioned previously I have moved my “Cash” choice back to Australian Super Cash fund. Rather than try and track and plot the different results when “Cash” is DiversifiedFixedInterest versus Cash, I have decided to take the more conservative and more pessimistic approach and just record the result for switching between 100% Australian Shares and 100% Cash fund. This causes results to be revised down but removes any backward (hindsight) bias and so gives a more accurate picture of the results.

As the plot now shows this Shares/Cash ProtectYourSuper is currently about 4% below the AustralianSuper Australian Share fund but slightly above the AustralianSuper Balanced fund as measured from July 2008. However the plot also shows that ProtectYourSuper has succeeded in avoiding the 20% and 30% drops the AustralianSuper Australian Share fund has experienced since July 2008 and so continues to for fill its aim of ProtectingYourSuper.

DiversifiedFixedInterest has dropped below the Cash line yesterday (15th August 2013) and AustralianFixedInterest has fallen also towards the end of last year and a little more recently, so I have switched my super to 100% Cash. My reason for this is that if interest rates rise then the returns from these funds would be expected to fall. So for the moment I am staying in pure CASH. I might change my mind later. ProtectYourSuper is about switching between 100% “Cash” and 100% Shares. Just what fund is used for the “Cash” part is a personal choice.

I have updated charts for this end of financial year. There are lots of headlines about the 21.6% increase in Shares this year. So why did ProtectYourSuper not do better? The first point to realize is that AustralianSuper Share fund lost 4.6% the previous year, so over the two years combine the increase is reduced to 17%. ProtectYourSuper, switching between Shares and Diversified Australian Fixed Interest, would have returned 14.9% over the last two years. That is only about 2% less than the AustralianSuper AustralianShare fund. However unlike the Share fund, ProtectYourSuper did not have a loss in either year. One of the aims of ProtectYourSuper is to protect against losses so the each year you can expect to still have more then 90% of your capital (based on the last 13 years of data).

That being said, I still investigated if a change to the ProtectYourSuper was warranted. The reason ProtectYourSuper did not participate in the shares rise last financial year was because, following Rule 3, the previous possible switch to shares did not return more then the 5% 'cash' rate. That is the return for the risk of being is shares did not out way the safety of 'cash' and so Rule 3 was not satisfied.

An obvious change would be to reduce the cash rate so that Rule 3 was satisfied and ProtectYourSuper would switch into shares in the first half of 2013.

It turns out to get this to happen the 'cash' rate has to be reduced to ~0%. Using the 'cash' rate of 0%, ProtectYourSuper would have switched into shares from May to June and would have returned 11% for the year and 17.9% for the two years. However the 3% gain over two years came at a cost. The capital dropped 7.5% in May 2012 as well as dropping 7% in June 2012. Overall reducing the 'cash' rate to 0% results only a 2.6% increase from 2008 to 2013 at the expense of additional significant drops in capital.

So I am leaving the 'cash' rate at 5% and am happy to miss some the share rises confident that once the share market starts its next 'bull' run, ProtectYourSuper will take part, in the mean time ProtectYourSuper will continue to be cautious about switching into shares.

I have updated charts for this quarter end and updated Protecting Your Super in Sideways Market. ProtectYourSuper is still in 'Cash' (AustralianSuper Diversified Fixed Interest) but using just the moving averages, there has been a profitable 'paper trade' switch into and out of shares. So rule 3 is now satisfied and so the next time the moving averages turn up, ProtectYourSuper will indicate a switch to Shares.

I have updated charts for this quarter end and updated Protecting Your Super in Sideways Market. ProtectYourSuper is still in 'Cash' (AustralianSuper Diversified Fixed Interest) in will remain there until it proves it can make money by switching to shares and back again.

I have made a few changes to the ProtectYourSuper user interface for V2.1.5 :- The results are now colour coded, green for switch to shares, red for switch to cash and black for no change since the previous week. There is extra checking for missing share data on Saturday mornings and a trading calendar has been added to handle Friday holidays.

I have made to changes to how ProtectYourSuper determines Rule3. Rule 3 is what make ProtectYourSuper different from all other moving average systems. Rule 3 says, “If using the moving averages did not make a profit last time, don't use them this time.” The changes in V2.1.4 are to how the “profit” is calculated. The changes are i) use Monday's closing share index (instead of Tuesday's). AustralianSuper uses Monday closing fund prices when switching so this change more closely aligns the result to the real life AustralianSuper results. ii) In order for a switch to shares to have made a “profit” the increase must exceed the “cash” rate (i.e. 5%). That is in order to be counted as a profitable switch to shares, shares must return more than would have been received just leaving the super in “cash”. Switching to shares is risky so the reward must at lease exceed the 'safe' cash return. These two changes produced a noticable improvement in results. As previously advised, my 'cash' fund is currently AustralianSuper's Diversified Fixed Interest fund.

Updated charts to show results for this quarter. See ProtectYourSuper in a Sideways Market for a discussion on why I am still in Cash.

After reviewing the performance of AustralianSuper's Diversified Fixed Interest Fund versus AustralianSuper's Fixed Interest Fund, I have decided to switch to Diversified Fixed Interest Fund for my “100% cash” fund. The Diversified Fixed Interest has not always been a better choice but it has out performed over the last 18 months. I will review this choice on a regular basis.

I have updated this page with the end of financial

year results compared to AustralianSuper Funds.

Yahoo finance is

publishing share data with errors. The Friday date is repeated with a

different close price and no volume.

I have updated

ProtectYourSuper to handle this data error.

It appears AustralianSuper uses the Monday's closing fund values when switching. Previously I calculated the AustralianSuper performance based on using Tuesday's values. I have updated the AustralianSuper performance chart below to use Monday's values. The switching program I use is unchanged and still calculates profit based on the ALL Ords Tuesday closing index. I may review that later but for now the results are good enough. So the end result is that I have just made the AustralianSuper performance chart more accurate.

I have updated the application program. No change to the results, but the application now checks if an update is available each time it runs.

I have changed the AustralianSuper Fund that I use for my '100% Cash' option. I now use the AustralianSuper Australian Fixed Interest Fund. This fund appears, on the limited data available, to go up as the share market goes down and go down as the share market goes up. Overall, since 2008, using the moving averages SMA11 and SMA33, the Fix Interest Fund gives better results than the AustralianSuper Cash Fund.

I have made a revised program available which downloads the share index data and does the calculations for the three rules used in this method and advise on when to switch. The program runs on Windows, Mac, Linux and Solaris. Installation and running documentation in pdf format is also available. This program also assists you if you want to start using the method by suggesting when to start switching. This version of the program (V2.1.0) produces the similar results as earlier versions but fixes some log messages and shuts down cleanly when the window is closed. V2.1.0 uses 11/33 as the two moving averages instead of 15/30 of V2.0. 11/33 gives better results based on past data.

Contact Forward Computing and Control by

©Copyright 1996-2024 Forward Computing and Control Pty. Ltd.

ACN 003 669 994