|

Home

| pfodApps/pfodDevices

| WebStringTemplates

| Java/J2EE

| Unix

| Torches

| Superannuation

| CRPS Treatment

|

| About

Us

|

|

Risking Your Superannuation

|

by Matthew Ford 23rd February 2025 (first posted 2nd

August 2020)

© Forward Computing and Control Pty. Ltd. NSW

Australia

All rights reserved.

Download

the free software RiskYourSuper1_1_3.jar

and

pdf documentation.

RiskYourSuper is more suited to a low interest rate environment. I am currently (6th Jan 2024) using ProtectYourSuper due to higher interest rates.

When the interest rate is low, I use RiskYourSuper because in a low interest rate environment the share market is the only place to make money. I control the level of risk I am comfortable with by a) investing in a Balanced Fund instead of a pure Shares Fund and b) only investing part of my super and leaving the rest in the Cash Fund. What is a 'comfortable' level of risk is a very personal decision based on such things as how long until you need to access your superannuation and how comfortable you are to switch to cash after the share market has fallen by 10% or more.

Legal Disclaimer: I do not hold a Financial Advisor’s Licence and nothing in this article should be considered as recommending any particular course of action to anyone else.

Installation

Windows:

1) Install Java 8

(important to use Java 8) from www.java.com

After downloading the java install file you need to add the “.exe”

to the file name to make it runnable. Then double click to install

java.

2) Download RiskYourSuper1_1_3.jar

3) Right click and create a ShortCut. Right click on the short

cut and open Properties and replace the highlighted Target: with the

cmd

C:\Windows\System32\cmd.exe

/k java -jar RiskYourSuper1_1_3.jar

-V

Then

double click the shortcut to run RiskYourSuper.

Installation Mac: jar does not open downloaded share data currently, use bootcamp to install Windows

Rule 1 – Invest in a Super Fund with

exposure to Shares and stay in that fund until the share market drops

by 10% from the last high.

Rule 2 – If not in 'shares'

then, stay in 'cash' until the 99 day moving averages starts to turn

up (on a weekly basis).

Rule 3 – Adjust the % of the

superannuation balance invested in shares to a 'comfort' level of

risk.

E.G

invest only a proportion of your super and/or invest in a Balanced

Fund instead of a pure share fund.

I currently have 100% of my Super in Cash in Hostplus. The last switch to Shares was not profitable returning 2.8% less then a nominal 5% cash fixed interest. This means ProtectYourSuper will stay in cash until a 'paper' trade switch to shares is profitable. ProtectYourSuper is waiting for a profitable paper trade switch, based on the moving averages, before indicating a real switch to Shares. In other words don't use ProtectYourSuper to switch to Shares if it did not return more than 5% last time. That is if the system is not working don't use it.

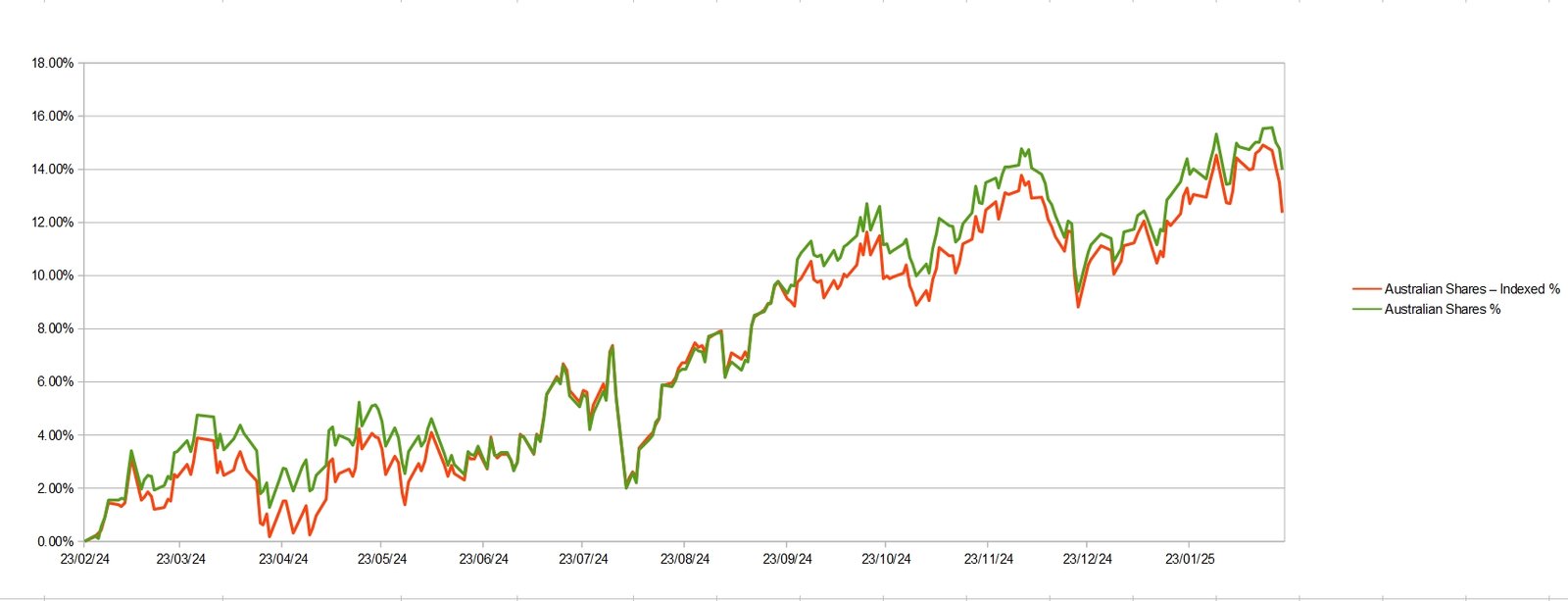

The chart below compares Hostplus Australian Shares with Hostplus Australian Shares Indexed. The expenses for Australian Shares is 0.47% versus 0.04% for Australian Shares Indexed. From the chart below it is debatable if the results are worth the extra expense. At the sharp drop on 5th Aug 2024, Australian Shares fell to 1.97%, while the Indexed fell to 2.01%. On the 20th Dec 2024, Australian Shares fell to 9.39%, while the Indexed fell to 8.8%. For the last date of the chart 20th Feb 2025, Australian Shares is 13.97% versus Indexed 12.36%. So sometimes Australian Shares does better then Indexed and some times it does about the same (but costs 0.4% more).

In future, I intend to switch from Cash to Australian Shares Indexed mainly because ProtectYourSuper switches based on the All Ord index, which Australian Shares Indexed most closely matches.

ProtectYourSuper was born out of the GFC and has been running since July 2009. Its aim was to protect the superannuation balance while participating in rises in the share market. It did this by using a set of rules to switch between 100% shares fund and 100% 'cash' fund. Initially the 'cash' fund was the Cash Fund. Later a Diversified Fixed Interest Fund was used as the 'cash' fund and more recently the a Property Fund was used as the 'cash' fund, but always with the proviso that if there was a major down turn, ProtectYourSuper would switch to pure a CASH Fund.

Choosing when to switch is a balance between the possible extra gain from the share market versus the extra risk in being in shares compared to 'cash' fund. When I started using ProtectYourSuper the 'cash' fund return was >5%pa and ProtectYourSuper spent most of its time in 'cash'. ProtectYourSuper was slow to switch to Shares. Only switching when there was a sustained rise in the share market and quickly switching back to 'cash' on each slight fall in the share market.

Now that the interest rates are almost zero and the return from property is negative, it is not attractive for my super to spend most of its time in 'cash' particularly when the share market is rising. As will be shown below, in spite of a weak economy over the last 10years the share market has continued to rise. While I cannot predict what will happen in the future, it is clear that at present the Australian government and other governments around the world are committed to injecting money to boost their economies. With world interest rates so low, this increase in government debt is not a noticeable burden.

This is the significant difference between the present economic environment and the Great Depression of the 1930's. During the Great Depression, governments cut spending which reinforced and prolonged the economic downturn. More recently the austerity measures imposed on Greece (2010 onwards) after the Global Financial crisis further depressed their economy.

Both the Australian Reserve Bank and the US Federal Reserve adjust interest rates to adjust the strength of the economy. If the economy is weak then they reduce the interest rate to boost it.

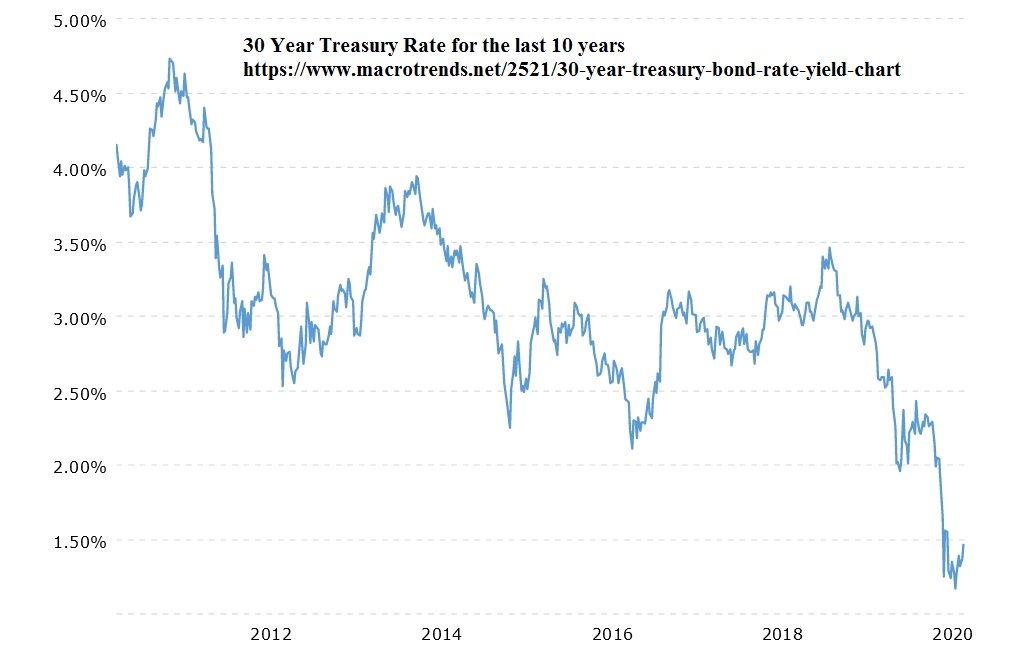

Here are two charts that illustrate the deterioration in the Australian and US economies over the last 10 years

Both these charts indicate that both the Australian and US economies have not recovered from the GFC and in fact have been getting over the last 10 years they have been getting weaker.

The above chart shows that the Australian Cash Fund rates have been falling since the GFC. It also shows why using an Australian Cash Fund as an alternative to investing in shares has become less and less attractive. The other 'cash' alternatives like Diversified Fixed Interest and Property Funds are also showing almost zero or negative returns.

Now contrast those interest rate plots, indicating weak economies, with the share market Australian All Ordinaries and the US SPX500 over the last 10 years

Before the latest fall in the Share market, March 2020, the Australian All Ords had risen ~60% over the previous 10 years and the SPX rose by ~200%. Neither of these rises in the share markets reflect the weak economies the Reserve banks are trying to correct. In other words the share markets of the US and Australia are becoming disconnected from the real economy, more so in the US than in Australia.

Since the 'cash' alternatives are providing zero return, this inflates the risk/reward ratio of shares. This, together with the rise of FANG (Facebook, Amazon, Netflix and Google) has been driving the US stock market, because There Is No Alternative (TINA) to shares for earning a return on your money. The Australian economy appears to entering a similar situation. This implies that the RiskYourSuper replacement for ProtectYourSuper should spend more time exposed to shares. The challenge is how to do this while still providing protection against significant falls in the Share market.

These are the ground rules on which RiskYourSuper was developed.

a) Only check the results once a week. I have a life

to lead outside of the share market.

b) Do not switch often than

once a month on average. Ditto

c) Don't back test beyond the GFC,

because the current economic conditions with very low interest rates

are very different now.

d) Stay exposed to Shares most of the

time, but still protect against sustained falls in the market.

After back testing a number of alternative approaches, the following seems to provide a usable but more risky approach.

Invest in a Super Fund with exposure to Shares and

stay in that fund until the share market drops by 10% from the

highest level when in invested in shares.

After switching out of

shares, stay out of shares until the 99 day moving averages starts to

turn up (on a weekly basis).

Here is the results of the back testing over the last 10 years

As you can see RiskYourSuper, (the Red line), follows the All Ords (the Blue line) most of the time and only switches out when the share market has dropped by 10% (or more) from the last high, when it was in shares. RiskYourSuper then stays out of shares until the 99 day Simple Moving Average (the Yellow line) starts to turn up. The Green line is high when RiskYourSuper is in shares and low when in 'cash' and shows that here were only 9 switches over the last 10 years. So most of the time there is nothing to do.

However note that RiskYourSuper does NOT switch out of shares until the share market has dropped by 10% (when check on the weekend). This is why I am calling this method RiskYourSuper, because it is usually in shares and it ALWAYS goes down by atleast 10% before switching to cash.

When you have a closer look at the %drop in the value when RiskYourSuper switches out, you see that while is usually about 10%, it can be larger, 15% to 16%.

Apart from the risk to the value of the superannuation balance, it can be emotionally very difficult to take the decision to switch out of shares after the value has dropped by 10% or more and there is a risk I may not switch to cash to protect my super from further falls. So I need to be comfortable with my ability to make that decision when the share market has already fallen and when I don't know how far or how fast it will continue to fall.

There are a number of ways to handle this emotionally

difficulty of making the decision to sell when the share have already

fallen.

a) Only switch a % of the super into Shares

b) Switch

into a Balanced Fund instead of a pure Shares Fund. Balanced funds

tend to fall less than the share market

c) A combination of a) and

b)

I chose to combine a) and b) and only put 50% of my super into Hostplus Balanced fund and left 50% in cash. Then when the share market falls by 10% and I need to switch to cash, only half my super is at risk and I expect the Balanced fund to fall less than the share market say only half as much. So a 10% fall in the share market will result in me switching out after loosing ~10% * 0.5 * 0.5 = ~2.5% of the value from the last high. Based on the previous 10years back testing I would expect this to happen, on average, less than once a year. Although in a server and prolonged downturn it could happen twice in one year.

Having used ProtectYourSuper for the last 10 years, I now find it is not effective when the interest rates are almost zero. There Is No Alternative (TINA) to shares for earning a return on your money in this economic environment. So I have replaced ProtectYourSuper with RiskYourSuper, which spends most of its time in shares and only switches to cash when the share market falls by more then 10%. have found that by selecting an appropriate super fund and using the simple rules described above, based a chart of All Ordinaries index available on the internet, that I am able to avoid heavy losses in my super over the last few years while still making gains now that the share market is recovering. I sometimes lose money switching into Shares and out again, but I catch the major rises in the market while avoiding the major falls.

Spending a few minutes once a week applying this method, lets me sleep peacefully every night when the share market goes in to a substantial decline because this method has has told me to put all my super into Cash and using this method also removes the worry about when I should put my super back into Shares as the market recovers.

The AustralianSuper performance was calculated for the daily differences available from their website. The All Ordinaries Share data was sourced from Yahoo 7 Finance The data was processed by Java programs written by me and OpenOffice V3.2.1 was used to plot the results.

Contact Forward Computing and Control by

©Copyright 1996-2024 Forward Computing and Control Pty. Ltd.

ACN 003 669 994